2.2 ASPSPs Members

Actors and definitions

PSD2 builds on the foundations laid down by the first directive to open the market for payments to new operators, and to realise the principle that is fundamental for real competition between operators: to establish ‘the same rules for the same services’ regardless of the nature of the subject - be it incumbent or newcomer - that offers them. In this way, PSD2 seeks to encourage the development of new forms of innovation and, therefore, competition, at the level of digital payments, with the prospect of offering more choices to end consumers.

Thanks to PSD2, users of an online payment account, for example, will have the opportunity to make payments or to obtain information on their account through the use of applications made by third-party providers (TPPs), who will have the right, based on proper consent from the user, to access the systems of banks (formally, account servicing payment service providers — ASPSPs) in ‘open’ mode. To allow this access in an open and secure way, the ASPSPs will also be required to implement the open technical interfaces necessary for dialogue with the TPPs and the management of the payment initiators (so-called payment initiation services) and account information aggregators (so-called account information services) carried out by users through these TPPs.: An open banking ecosystem to survive PSD2

This will subsequently make it possible to improve the customer experience by leveraging new services and new offers.

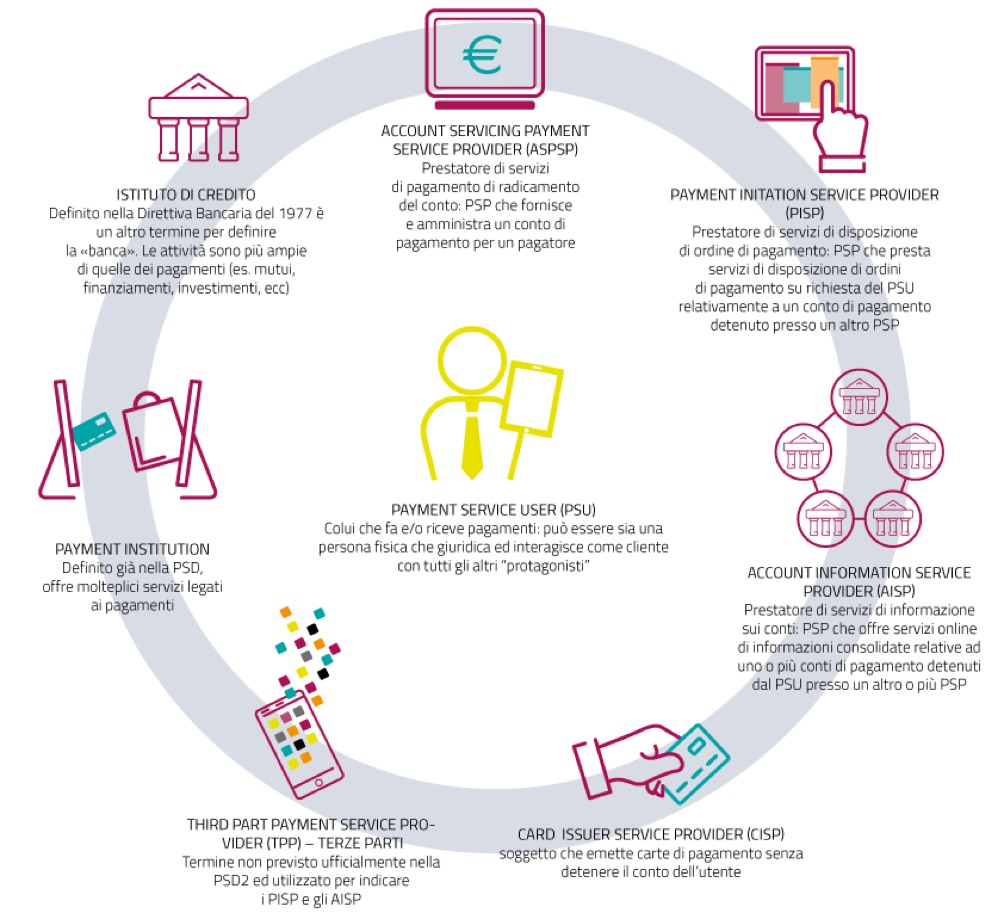

Following the actors expected and the related acronyms used in the document:

- PSU - Payment Services User

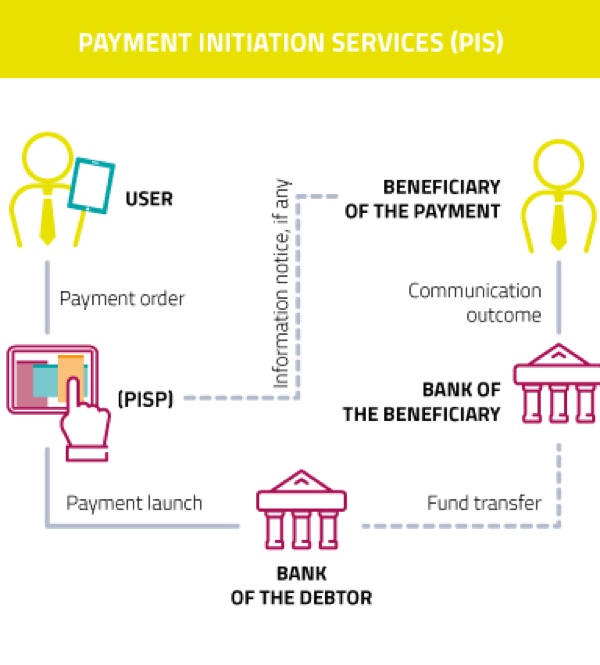

He is the subject using all the payment services defined and provided by the PSD2 ecosystem. - PISP - Payment Initiation Service Provider

This entity provides the PSU with the service to set up payment transactions; the related services supplied can be identified as PIS (Payment Initiation Service). - PIISP - Payment Instrument Issuing Service Provider (also known as CISP – Card Issuing Service

Provider).

This entity provides information about the funds availability on PSD2 payment transactions based on the payment cards. The related services supplied can be identified as FCS (Confirmation on the Availability of Funds Service). - AISP - Account Information Service Provider

This entity offers information services about the payment accounts. The related services can be identified as AIS (Account Information Service). - ASPSP - Account Servicing Payment Service Provider

This is the entity where the payment accounts resides. It receives payment requests, receive payments, provides information on managed payment accounts. - TPP - Third Party Provider

A general definition of the provided services inside the PSD2 on behalf of a PSU. A TPP may have one or more of the PISP, AISP, PIISP roles and it is able to communicate with the involved ASPSPs through the interfaces defined by the PSD2 Gateway.

In particular, the PSD2 governs other activities of PSPs in the European market of payment services by introducing three service models, under which new players can build the services they offer.